Capacity, efficiency and reliability are the mantras for network operators planning their next-generation transport networks. Open hardware and software hold the keys to meeting many operators’ needs, but open transport has its own challenges to address.

In May 2022, Heavy Reading conducted the inaugural Open, Automated & Programmable Transport Networks Market Leadership Survey with project partners Ciena, Fujitsu, Infinera and Juniper. The 2022 survey attracted 78 qualified network operator responses from around the world, sharing their views on transport automation timelines and requirements, cloud automation, optical line systems and IP over DWDM.

This is the final blog in a four-part series highlighting the key findings from the 2022 study. It focuses on optical line system goals and orchestration and control.

Drivers for new optical line systems

As described in the last blog, the top drivers for managing and automating open optical networks are optimizing network capacity, increasing end-to-end network visibility and improving network resiliency. Each of these drivers was selected by more than half of respondents.

Optical networks can be broadly divided into two components: the terminals/transponders and the line system, which includes ROADM, amplifiers and multiplexers/demultiplexers. In this blog, Heavy Reading delves into the drivers specifically for evaluating new optical line systems.

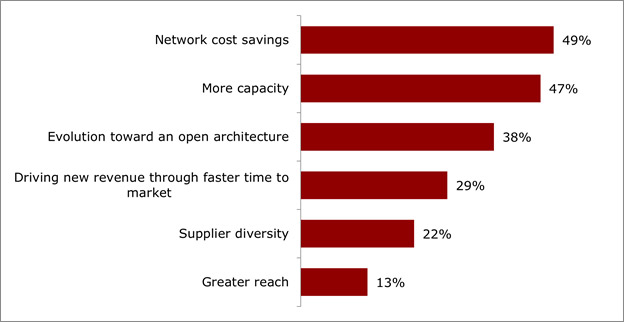

According to the survey, the top drivers for evaluating next-gen line systems are network cost savings (selected by 49% of respondents), followed closely by requirements for new capacity (selected by 47%). Cost and capacity are requirements that are fundamental to the mission of optical networks, so it makes sense that they continue to be the primary drivers for system upgrades. The migration to C+L-band line systems is a prime example of how network operators are planning to double capacity as the C-band approaches the Shannon Limit.

The evolution toward an open architecture ranks third on the list of drivers (at 38%). While it is important, the majority of operators do not consider an open architecture to be the primary driver for evaluating a new line system. The data suggests, rather, that the trigger for RFPs will continue to be requirements to lower cost per bit and to add capacity to meet traffic demands. However, the introduction of an RFP will be the entry point for operators to add their new requirements for open architectures into the mix. Additionally, some operators may view open architectures as the means to the end of lowering their network costs.

What are the most important drivers for deploying a new line system?

n=77

Source: Heavy Reading

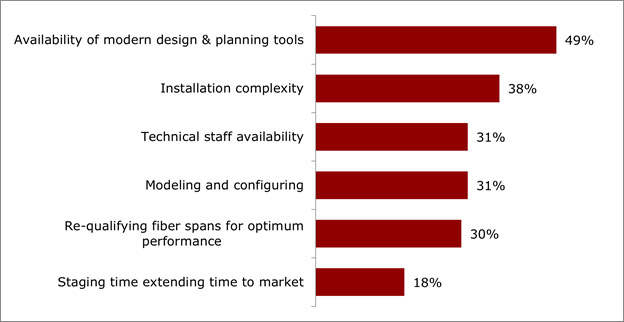

The need for modern planning tools

The availability of modern design tools is the top operational challenge when planning and deploying more complex optical line systems (i.e., greater than 2 degrees). Nearly half of the survey group (49%) selected modern design tools as the top challenge, well ahead of any other challenge. Real-time and automated functions are key components of modern design and planning tools that help plan optical network capacity more efficiently and simplify the overall process. Notably, installation complexity ranks second on the list of operational challenges. The greater availability of modern design tools will help remedy this challenge, as well.

What are the most difficult operational challenges when planning/deploying

anything greater than a 2-degree line system?

n=77

Source: Heavy Reading

Addressing control and orchestration

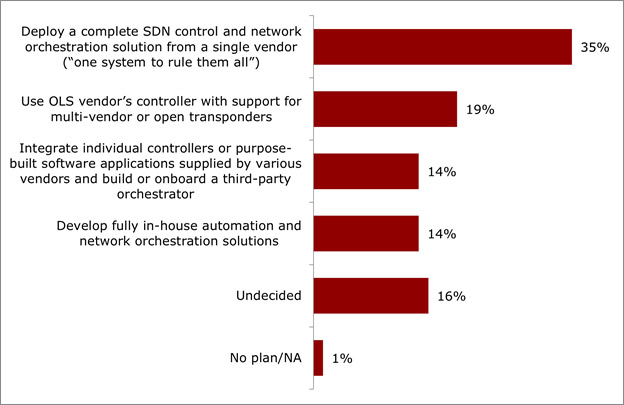

When it comes to control and orchestration for open optical networks, a plurality of 35% of respondents prefer to deploy a software system from a single vendor. This finding is not a surprise, given the complexity of what service providers aim to achieve. Open, multi-vendor optical networks must integrate hardware platforms across multiple vendors (and possibly multiple OSI layers as well). Using multiple software platforms to integrate multiple hardware domains adds additional complexity and opens the door for cost overruns and delays.

The preference for single vendor orchestration and control also points to the lack of standardization maturity in this area despite work from multiple industry groups over the past decade, including Telecom Infra Project (TIP), Open Networking Forum (ONF), Open ROADM, Optical Internetworking Forum (OIF) and others.

Heavy Reading identifies “priority adopters” as the subset of survey respondents who feel network automation is critical to their network strategies and who are also furthest along. Tellingly, these automation-savvy priority adopters are even more likely to prefer a single vendor for control and orchestration.

Of least interest to the operators surveyed are the patchwork of the software supplier approach and the in-house do-it-yourself approach. Again, these findings point to the complexity of multi-vendor integration and the lack of mature standardization in this area.

What is your plan for control and orchestration for open optical networking?