Get your shovels ready

The floodgates to the $42.5 billion federal Broadband Equity, Access and Deployment (BEAD) Program funds are starting to open. In December 2023, Louisiana became the first state to be approved, unlocking the state’s $1.3 billion allocation. “We will start executing on shovel-ready projects in 2024,” said Louisiana Governor John Bel Edwards.

More expensive deals

Broadband fiber assets can provide the stable, long-term cash flows that attract digital infrastructure investors. But the rising global demand for such deals is making them more expensive; McKinsey found that average earnings multiples for fiber asset deals rose from 16.8 in 2018 to 19.7 in 2021.

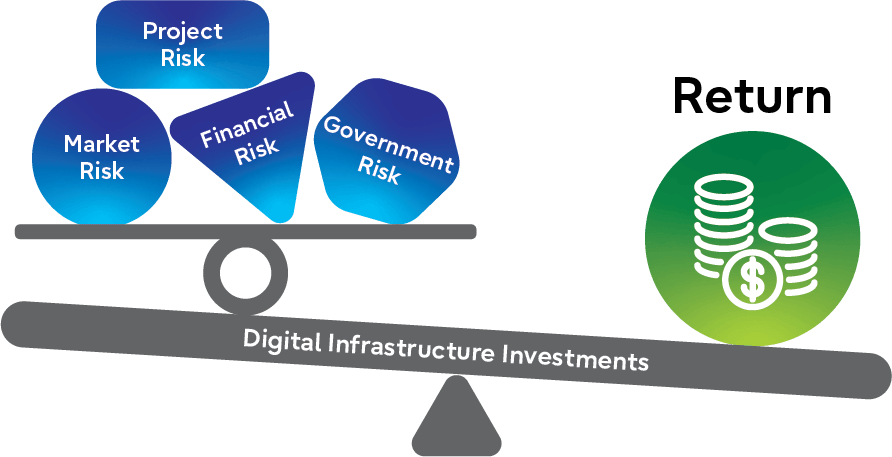

Risk factors

Headwinds in the current macroeconomic environment are also layering additional risk to digital infrastructure projects. Inflation raises construction costs while eating into consumers’ wallets, potentially making them more price sensitive. High interest rates raise the bar on performance expectations of each investment. An industry shortage of skilled labor may impact schedules, as well as the quality and scale these projects can achieve. And competition for subscribers continues to intensify; from 2015 to 2023, inflation-adjusted broadband prices in the US have fallen by 55% while average download speeds have increased by 142%.

The good, the bad, and the ugly

Meanwhile, the industry’s track record has been somewhat mixed. In one early municipal project, $17 million was inappropriately used to forestall bankruptcy, accompanied by a political scandal, financial rating downgrades, and even an FBI investigation. Overall, projects led by utilities have fared well. In a NRTC/NRECA study on 88 rural electric cooperatives that have deployed broadband, the median take rate was a healthy 46% and the internal rate of return achieved was 9%. Strong performance for one middle-mile P3 project led to a recent ratings upgrade to Baa1. There have been many lessons learned, but a standard playbook has yet to emerge. Project-specific terms, structures, and partnerships will be key to the ultimate success of any infrastructure investment.

Looking ahead

The anticipated rise in digital infrastructure deals in 2024 will be tempered by greater caution on the part of investors. Realistic project forecasts, comprehensive due diligence, and a focus on operating cash flows will be key factors as the infusion of BEAD funding kicks off a new wave of broadband infrastructure projects to help balance the capital stack that investors require.

Fujitsu’s turnkey services

With 3,600 North American infrastructure projects under our belt, Fujitsu has extensive expertise in assessing, designing, building, operating, and maintaining fiber and wireless networks.

Metro Connect USA 2024

Schedule a meeting with our broadband team to discuss risk mitigation strategies, and how our consulting, design, build, operate, and maintain services can support your digital infrastructure project.