Part 2: Who are the Heroes?

In Part 1, I introduced a new approach to broadband, where a group of independent players team up to deliver a disaggregated broadband project by combining the unique abilities of each. Let’s do a walkthrough of the supers in our disaggregated broadband league and summarize how they interrelate, what role each plays, and what capabilities they bring to the project.

The Project Owner

These are often local entities that want a network to better serve their area. These entities might be municipalities, counties, states, provinces, tribes, or suburban private networks of any kind. They may want more control over the coverage, new competition for their end-users, or to energize community investment by being on-set. After all, broadband is the fourth utility (apologies to the compressed air people who think they are the fourth utility – but I have to let you know it’s broadband).

An insight to share: These project owners need a healthy dose of political will, in terms of popular support, and grit, in terms of determination to stay the course and get to an actual finished project no matter the obstacles. Infrastructure projects take persistence over time.

The Network Investor

Network investors are financial institutions that represent an emergent segment of the broadband market. They may be individual investment banks, consortia, or fund managers. These are investors seeking stable, dependable long-term returns over a 20- to 25-year time frame. Network investors are infrastructure finance experts that help develop funding plans and can also coordinate and prepare applications for state and federal grants. These investors work with the network design/build, integration, and operations/maintenance partners who develop architectures, budgets, schedules, and project plans. Using this information, the investor builds a package combining grants, debt, and equity.

The Project Entity

This is the business entity created by the project owner to manage the broadband business as a separate concern.

The Internet Service Provider (ISP)

The ISP is responsible for onboarding customers, managing customer relationships, and delivering the service. They also handle billing and provide direct customer support (i.e. help desk). A broadband project entity/owner may have relationships with more than one ISP. One example is where a network serving one region attracts interest from ISPs in adjacent regions looking to scale up their business.

For the project owner, an important strategy decision is whether to have a closed-access model, in which a single ISP is exclusively contracted to deliver service; or an open-access model, a relatively recent approach where several ISPs deliver services, opening up more competition and customer choices in the area served and more volume for the NI. Open networks add a new layer of complexity, so choosing an O&M provider that offers broadband open-access management is key.

Systems Integrators & Design/Build/Operate/Maintain Partners

Design/Build (DB) and Operations/Maintenance (OM) functions may be provided by a single partner or several. There are important advantages to choosing a single partner to serve DBOM in its entirety meaning not just Broadband Systems Integration (the design/build), but also the broadband solution management (the operations and maintenance of the network). This blog assumes that to be the case. By contracting a single partner for DBOM, the difficult issue of gaps and overlaps between the DB and OM (the Interface Agreement) is avoided and finger-pointing, excess costs, and overruns due to “not my job” reactions are prevented.

The DBOM partner collaborates with the network investor to iterate on and eventually determine the architecture, technologies, network products/equipment, and inputs to the network investor’s business case.

One important advantage of single-partner DBOM is that a single contract can govern the Service-Level Agreement (SLA) and coverage for the entire network. This eliminates confusion about who supports what and provides efficient documentation and knowledge transfer. Another advantage is flexibility in terms of build-operate-transfer arrangements, in which the project entity eventually takes over OM responsibilities once the network is built-out and running smoothly.

A network build typically takes 12-18 months, or more, to complete, so the DBOM partner must have the capabilities and capacity to support projects at scale on this kind of time frame.

Also on the buying checklist is that the DB partner must have both inside-plant and outside-plant capabilities in-house (rather than outsourced), so that they can fully support the best tradeoffs between the two in terms of options and combinations for the project. By doing so, another interface contract is avoided, and gaps and misunderstandings are eliminated, assuring the build stays on-budget and completes on-time.

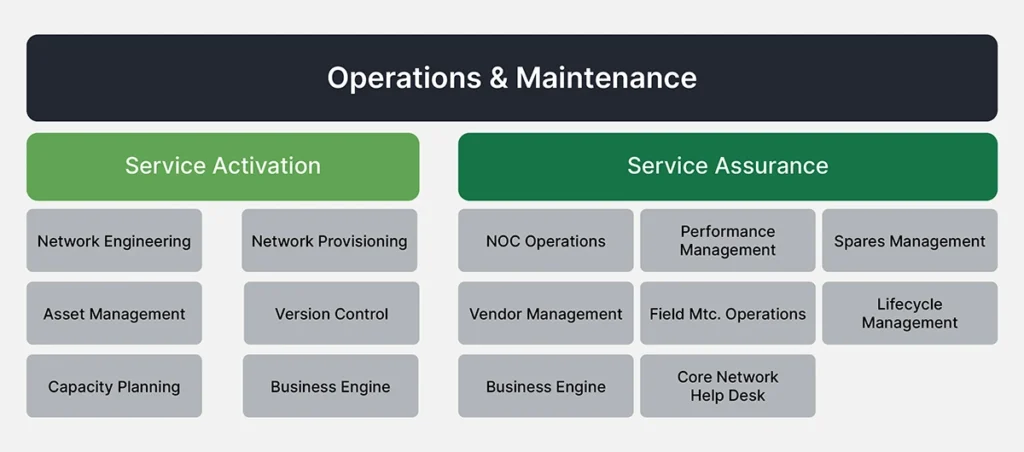

Operating and maintaining the network covers many functions. The diagram below breaks out the taxonomy of what’s covered. Operations and maintenance are both complex and critical in terms of enabling faster time to revenue and therefore, faster time to ROI.

O&M is an area where it is important to recognize that AI is not a trend; it is a means of transformation for lower costs, higher network reliability, and greater efficiency. AIOps in particular, meaning the use of AI tools to enhance operational and maintenance capabilities, is key to opex reduction and cost control. To select an O&M partner, make sure you evaluate their AIOps capabilities.

Coming Up…

In Part 3, I’ll explain how to determine if a partner is extraordinary versus merely ordinary and provide an overview of mission planning and strategy. You can also explore content about 1Finity’s turnkey broadband solutions on our website.