Network operators have one eye trained on the rollout of their 5G services, and the other is focused on a future of unforeseen challenges and uncertainty as to whether they will have the flexibility to adapt. A vendor-neutral, interoperable Open RAN ecosystem could go a long way toward positioning networks to meet their long-term financial, technical and performance goals while giving them the flexibility to quickly pivot and adjust to the unexpected. Many in the market are aggressively working to make the idea of a completely open radio access network a reality. Others worry of integration challenges. So, who’s right?

The Open RAN promise

Regardless of which camp you’re in, it is hard to deny the benefits of Open RAN. The ability to take advantage of faster innovation, savings from increased competition and a more resilient supply chain offers tremendous benefits.

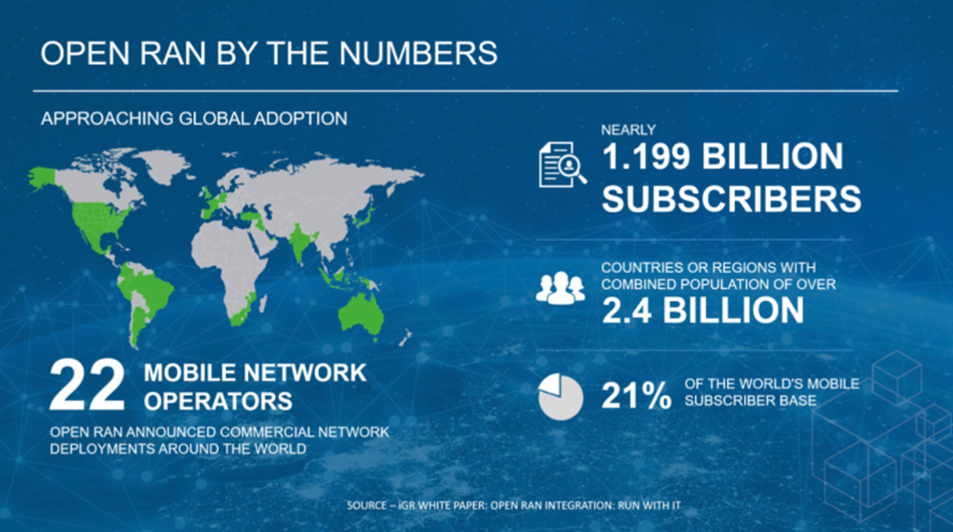

“We estimated as many as 75 countries could see Open RAN become relevant. These include countries where 5G is not yet deployed, where 4G or 5G may need to be expanded, or where there are roaming agreements in play.”

-Hakan Ekmen, CEO Telecommunication, Umlaut

Cost savings is a huge part of Open RAN’s allure. According to a May 2022 post on Tele.net, the total cost of ownership of a traditional RAN accounts for 65-70 percent of a mobile network’s total cost. Industry estimates suggest operators can save up to 40-50 percent on CapEx and 30-40 percent on OpEx by using O-RAN frameworks.[i]

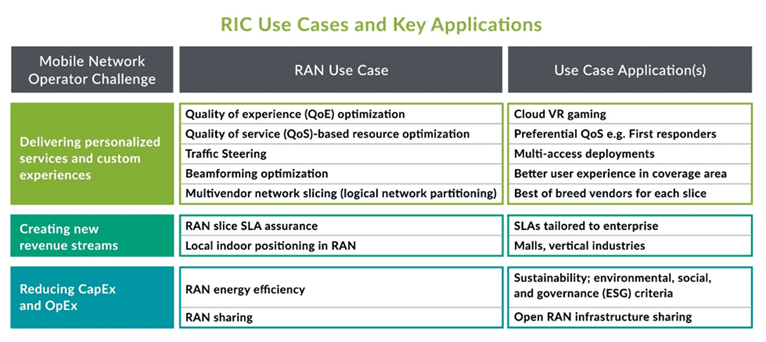

At the same time, the O-RAN architecture could address several other pressing concerns for network operators, largely thanks to the RAN Intelligent Controller (RIC). The RIC is responsible for controlling and optimizing RAN functions.

Early adopters vs. laggards

Fueled by efforts of tier 1 telecoms, mobile networks and broad initiatives, including the Open RAN Alliance, Telecom Infra Project and GMNM Alliance, Open RAN architectures, components and standards continue to advance. The progress is translating into an uptick in O-RAN deployments and trials—a sign that the trend may be ready to turn the corner.

Currently, Japan’s Rakuten Mobile lays claim to the world’s largest Open RAN network—40,000 sites and 200,000 radio units—while NTT DoCoMo has built the world’s largest brownfield Open RAN footprint.[ii] Based on the O-RAN Alliance’s fronthaul specification, NTT DoCoMo deployed over 10,000 5G O-RAN sites in 2021 and will deploy an additional 10,000 by the end of 2022[iii]. In the US, DISH has deployed Open RAN in over 120 markets covering 20% of the population. Not to be outdone, Vodafone has announced plans to implement O-RAN at 30% of its more than 100,000 European sites by 2030.[iv]

Other notable players aggressively pursuing the new ecosystem include Telefonica, AT&T, DISH, Etisalat, AirTel and MTN. Telcos have been aided in their efforts to open the radio access network by a range of equipment vendors and system integrators. For example, in April, Fujitsu Network Communications announced it is providing 5G Open-RAN radio units to the Evenstar Open RAN program, an initiative of the Telecom Infra Project (TIP). The 3.5GHz RUs support massive MIMO and use the Open RAN standardized interfaces.

“Deloitte estimates that there were, as of December 2020, around 35 active Open RAN deployments across the globe. 85% of these involve Telcos deploying Open RAN in developing markets, the majority being in rural areas.”[v]

Still, many less aggressive mobile operators are taking a more cautious approach. Their concerns are mainly focused on whether the Open RAN framework and ecosystem are sufficiently mature so that the benefits—in terms of savings, innovation and flexibility—outweigh the cost of implementation. This is one reason that Open RAN has greater initial appeal for greenfield deployments versus brownfield expansions. That’s why operators like DISH and Rakuten, who are building new infrastructure and essentially working with a clean slate, aren’t hesitating to go with Open RAN from the start.

Many of the concerns seem to stem from past experiences; operations managers have lingering memories of complex hot-swap cutovers in the middle of the night and fear the incremental intricacy of a multivendor network. As a result, they wonder whether Open RAN’s multivendor interoperability is sufficient. The degree of effort and accountability needed for systems integration is also a concern, not only for the initial deployment but also for the ongoing maintenance throughout the solution’s lifecycle.

As with any disruptive technology, there were challenges when Open RAN was first introduced. But as the framework and ecosystem have matured, deploying and supporting Open RAN installations have become easier and the bottom line benefits have increased. For example, with virtualization disaggregating hardware from software, performing software upgrades is faster and easier. In fact, many of the operators that embrace Open RAN now choose to upgrade their software on an almost daily basis, enabling them to continuously optimize their network. Automation is increasingly used to streamline regression testing to ensure network reliability while coping with the asynchronous timing of different suppliers’ patching and software development schedules.

Understanding O-RAN costs vs. benefits for your network

Given the current initiatives and the strength of its overall business case, widespread adoption of Open RAN is a matter of when not if. The timing will vary depending on each operator’s perception of the costs of adopting Open RAN versus the benefits.

To help you understand the key variables of the Open RAN cost vs. benefit equation and how they have changed over recent years, watch the Session Two keynote presentation by Greg Manganello from Mobile World Congress Las Vegas. He offers a practical look at where we are and what operators should consider as they move forward.

[i] Open Networks: Operators turn to O-RAN to lower network deployment costs; Tel.net, post; May 2022

[ii] Changing the radio access network for good; Gazettabyte, post; July 17, 2022

[iii] NTT DoCoMo pitches open RAN smarts plus 13-vendor dream team; Light Reading, article; March 22, 2022

[iv] Reviewing Vodafone’s Open RAN System Integration white paper; Light Reading, review; June 22, 2022

[v] The Open Future of Radio Access Networks; Deloitte/Telecom Engineering Centre of Excellence, report; 2021