According to the International Telecommunication Union (ITU), global mobile data traffic, including Machine-to-Machine (M2M) traffic, is expected to grow to 607 Exabytes (EBs) per month by 2025, climbing to 5016 EB per month by 2030.

To meet demand and manage proportionate growth in network complexities and data volume, network operators are exploring new virtualization technologies and how they can use Artificial Intelligence and Machine Learning (AI/ML) in their existing 4G/5G networks.

Virtualization of the RAN will support billions of endpoints with far more flexibility and agility than hardware-based RANs are capable of, as well as improving resilience and simplifying network maintenance. The associated increase in network data volume and availability that virtualization enables can provide an unprecedented opportunity for network operators to learn more about the actual behavior of individual user equipment and associated traffic.

Operators can use that information to deliver individualized services and products that evolve over time. This kind of advanced network intelligence requires AI to help design, operate, maintain, and manage communication networks and services. AI will help network operators learn more about their networks and customer needs, help identify ideal decision/actions for different scenarios and environment conditions, and finally, improve the ability to collaborate between highly heterogeneous networks with densified network infrastructures.

Fujitsu recently partnered with Heavy Reading to conduct a global survey to gauge network operators’ virtualization initiatives and their plans for implementing AI/ML. Our goal was to learn how committed network operators are to these capabilities, their timelines for implementation, and their priority use cases.

Heavy Reading survey readout: “Virtualization, AI, ML, and the Vendor Landscape”

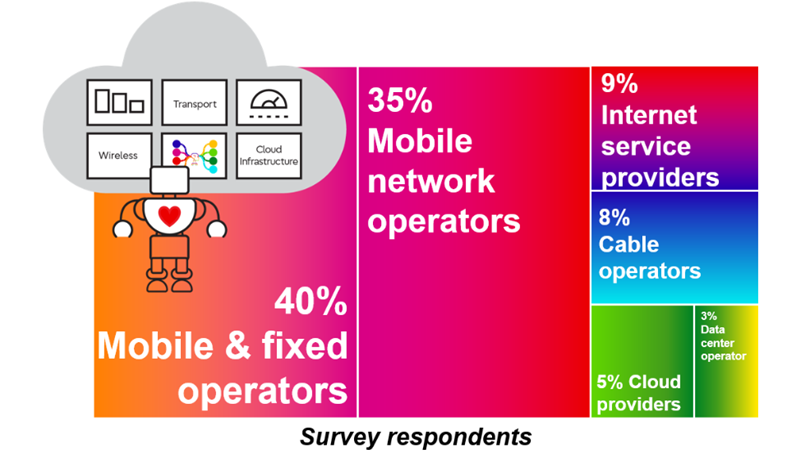

Heavy Reading surveyed Communications Service Providers (CSPs); the sample included mobile and fixed operators, mobile network operators, internet service providers, cable operators, cloud providers, and data center operators. Here’s how they responded.

Summary

It’s difficult to find a network operator that isn’t looking into virtualization and investigating possibilities for deploying AI/ML. Most are committed to virtualization and AI/ML, and planning phased implementations. Most believe that adopting these technologies will require them to rethink their current vendor relationships.

The scope of virtualization technologies is growing

When network operators think about virtualization today, it’s about more than using virtualization software to run virtual network functions on Commercial Off-theshelf (COTS) servers. Virtualization technologies have grown to include virtualization-based security; cloud-native applications delivered via cloud computing; and virtualized network functions that extend from the edge of the network to the core to the cloud.

More than half of network operators plan to invest in virtualization in the next two years. The top three network function initiatives are core network functions, cloud-based functions, and security network functions.

- 40% of respondents are currently virtualizing core network functions, while 40% are planning projects in the next 12–24 months

- 39% of respondents are migrating applications and network functions to the cloud right now, with 40% planning to do so in the next 12–24 months

- 35% are virtualizing security functions right now, with 36% in the next 12–24 months.

Top virtualization use cases are network slicing, service provisioning, and quality of service

Given most network operators’ virtualization function priorities, it makes sense that the top virtualization use cases are network slicing, service provisioning, and quality of service. With Fujitsu’s commitment to open, automated networks, we are thrilled to see that roughly 80% of network operators will explore O-RAN traffic steering and resource sharing in the next 24 months.

Network operators are using AI/ML in pre-deployment testing right now

Automation is known to save testing time and reduce errors, helping get new services to market faster at lower costs. Operators are using AI/ML to extend existing automation by reducing testing gaps with real-time data analysis and intelligent automation. We found that roughly half of network operators are planning to use AI/ML in the pre-deployment testing phase, with an average of 26% planning to use AI/ML right now. As network operators’ capabilities rise in terms of highly-scalable networks and software quality associated with dynamic network slicing in 5G+ networks, another 38% of respondents indicate that they plan to use AI/ML in the next 12–24 months.

Top AI/ML use cases are anomaly detection, KPI service compliance, and network slicing

Anomaly detection and KPI service compliance (including quality of service) are tied for the top use case, closely followed by network slicing. Given the amount of fault data that can be collected and aggregated from domain network management tools, it’s not surprising that anomaly detection and quality of service are among the first use cases network operators will explore as they build out their 5G networks.

Research suggests that multivendor frameworks will address concerns about costs and interoperability

Virtualization has the potential to disrupt the traditional incumbent model, allowing incumbent and non-incumbent vendors to coexist in an intelligent network. A barrier to multivendor coexistence is proprietary network infrastructure and functions. That drives up costs, reduces interoperability, and limits internal skill sets to those dictated by vendors’ narrow capabilities.

Network operators apparently plan to address those challenges with strategies that include open architectures that use standard interfaces. 31% of network operators are shifting aggressively to vendors that support an open multivendor software environment, and 54% say they may shift to vendors that can work in an open multivendor software environment.

The adoption of open standards and APIs helps up-level internal skillsets for 5G integration and lifecycle services by providing meaningful access to more technologies and services. Staff also gains access to working groups and open standards communities who are working on the same problems across multiple network domains, network operators, and vendors.

Break through the status quo with virtualization and AI/ML

This Heavy Reading survey and the research detailed in the white paper confirm that Network Operators are “all in” on implementing virtualization and AI /ML. Network operators are investigating how they can achieve virtualized, automated and optimized operations in the core and the cloud, followed by the edge. They will take a phased implementation approach to these capabilities. Wary of high solution costs, network operators are balancing the costs of technology switching with the ability to offer new services.

Network Operators understand that they may need new vendor relationships to meet ambitious goals for new revenue streams. And while virtualization and AI/ML initiatives may be in separate phases for now, use cases like service level assurance for dynamic network slicing can bring them together, ushering in a new era of CT/IT convergence.

Download the Heavy Reading white paper

for more insight on Virtualization, AI/ML, and the vendor landscape.